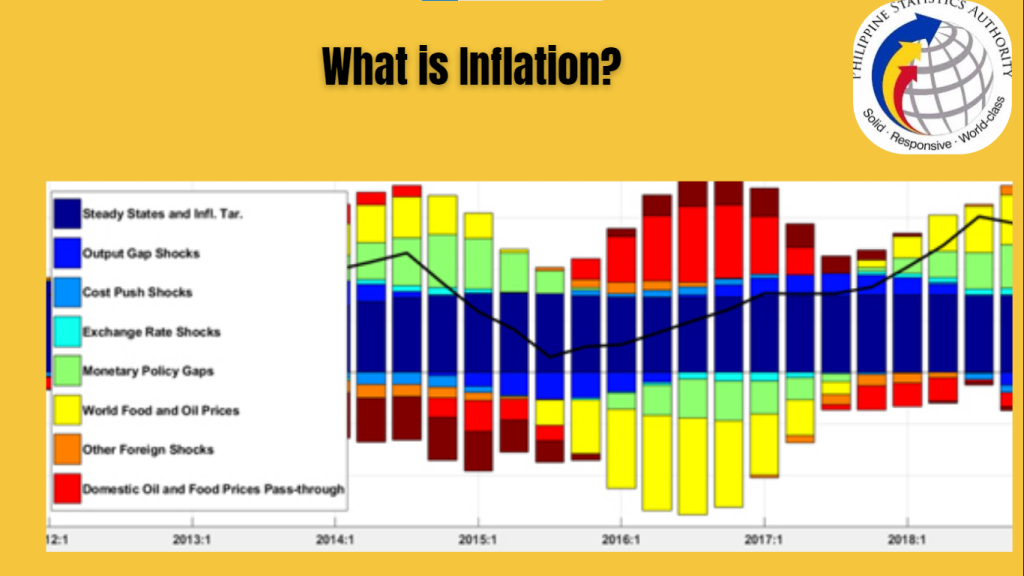

Unpacking Inflation Dynamics in the Philippines

Inflation affects everyone, from the increases at the neighborhood palengke, to rising transport and housing costs. But for Filipinos, inflation, if these reports are to be believed, is the framework within which we make wise financial decisions. What is inflation, why does it occur, how is it affecting the Philippines, and what can the government and people do about it?

What is Inflation?

Inflation is the general increase in the cost of things over time. Inflation, on the other hand, is when each peso you spend today purchases less than previously. So if a kilo of rice cost ₱50 at this time last year and it now costs ₱55, then that’s inflation in the making.

In the case of the Philippines, the CPI is used as the inflation measure. Roughly, CPI refers to changes in the prices of a basket of goods and services that households tend to consume.

Inflation in the Philippines: What behind it?

Philippine inflation is shaped by both domestic and global factors. Here are the key drivers:

Demand-Pull Inflation

When the demand for goods and services exceeds supply.

For example, prices naturally rise during periods where more money is in circulation, such as during holidays (e.g., Christmas).

Cost-Push Inflation

Occurs when production costs increase, causing prices to rise for consumers.

Exchange Rate Fluctuations

Currency depreciation makes certain imports expensive (fuel, electronics).

For example, when the peso depreciates against the US dollar, it becomes more expensive to import rice and oil.

Global Events

Things like the Russia-Ukraine war or supply chain outages could drive prices higher.

Government Policies

Changes in taxes, tariffs or subsidies can affect prices.

For one, it added excise taxes on fuel under what is known as the Tax Reform for Acceleration and Inclusion or TRAIN Law, which inflamed inflation.

Impact of Inflation on Filipinos

Inflation is felt differently across different sectors of society:

For Consumers: Sooner or later, higher prices mean less purchasing power. Families may find themselves unable to afford their most basic needs through electricity and transportation as well as food.

For Businesses: Higher costs of raw materials and labor can pinch profit margins, driving companies to raise prices or lay off workers.

For the Economy: Elevated inflation can lead to slower economic growth, as consumers spend less and businesses invest less.

Current Inflation Trends in the Philippines

Trends in inflation depend on a wide range of variables, like monetary policy, global economic conditions, supply chain dynamics and domestic demand, whose trajectory is very hard to predict accurately.

For 2025 figures you can find sources closer to the date, or updated economic predictions.

How the Philippine Government Manages Inflation

INFLATION CONTROL The government and the Bangko Sentral ng Pilipinas (BSP) have a very important role to play in curbing inflation. Here’s how they do it:

Monetary Policy

One of the ways the BSP fights inflation is via interest rate changes. High interest rates work to pull down spending and borrowing, which slows inflation.

Fiscal Policy

The government can also ramp up its subsidies or lower taxes on essential goods to lessen the cost burden on consumers.

Supply-Side Interventions

Initiatives such as Kadiwa ni Ani at Kita allow farmers to sell straight to consumers at lower food prices.

Tips for Filipinos to Cope with Inflation

While inflation is something we can’t control as individuals, there are things we can do that can help mitigate the effect of inflation:

FAQs

Conclusion

Inflation, the rise in prices, is a complicated yet natural feature of the economy. For Filipinos, the first step to lessening its impact is locating its causes and effects. Staying informed and practicing good financial habits will help you manage the challenges of inflation better. It is up to the government and the BSP to sustain measures that promote price stability and economic growth.